The Self-Driving Portfolio (“SDP”) is an autonomous, all-asset portfolio much like the “robo-portfolios” major investment firms (e.g., Vanguard, Schwab, or Fidelity), however this portfolio is fully invested among all asset classes with a downside buffer in the form of a covered-call options overlay.

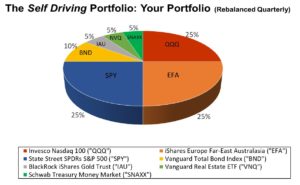

The SDP is balanced quarterly to maintain allocation percentages, diversified among between eight to 12 various ETFs, each with low internal fees for long-term capital appreciation and income.

EXAMPLE OF A TYPICAL SDP PORTFOLIO:

Unlike regular mutual funds, the funds in this portfolio are eligible for call option trading, enabling additional income and a hedge against a down market. In an attempt to meet the benchmark, we try to match the index and then sell covered-calls to beat the benchmark. Examples of the SDP holdings are the following: Vanguard Real Estate Index ETF (symbol: VNQ), BlackRock Biotech iShares (“IBB”), VanEck Semiconductor Index (“SMH”), Nasdaq-100 Invesco ETF (“QQQ”), State Street Dow 30 SPDRs Index (“DIA”), SPDRs S&P 500 Index (symbol: SPY), among dozens of other liquid ETFs, all trading on the New York or American stock exchange.

*Source: Investopedia, “Expense Ratios of Typical Domestic Equity Mutual Funds,” June 14, 2021.